The True Cost of Losing an Executive & the Best Ways of Structuring Plans to Retain Executives

Many companies tend to be myopic as it relates to understanding the true cost of losing an executive. It is important for companies to focus on the “total” costs that will accompany the loss of an executive, particularly an extremely talented executive.

The real cost of executive turnover is, for the most part, an unknown. This is largely due to the fact that most companies don’t have systems in place to track exit costs which can include the following:

-

Recruiting

-

Interviewing

-

Hiring

-

Orientation

-

Training

-

Lost productivity

-

Potential customer dissatisfaction

-

Reduced or lost business

-

Administrative costs

-

Lost expertise

It takes collaboration among departments (HR, Finance, Operations) which, in effect, need to develop tools to measure these costs concomitant with reporting mechanisms. As we all know, collaboration between two departments, much less multiple departments, on any issue can be challenging.

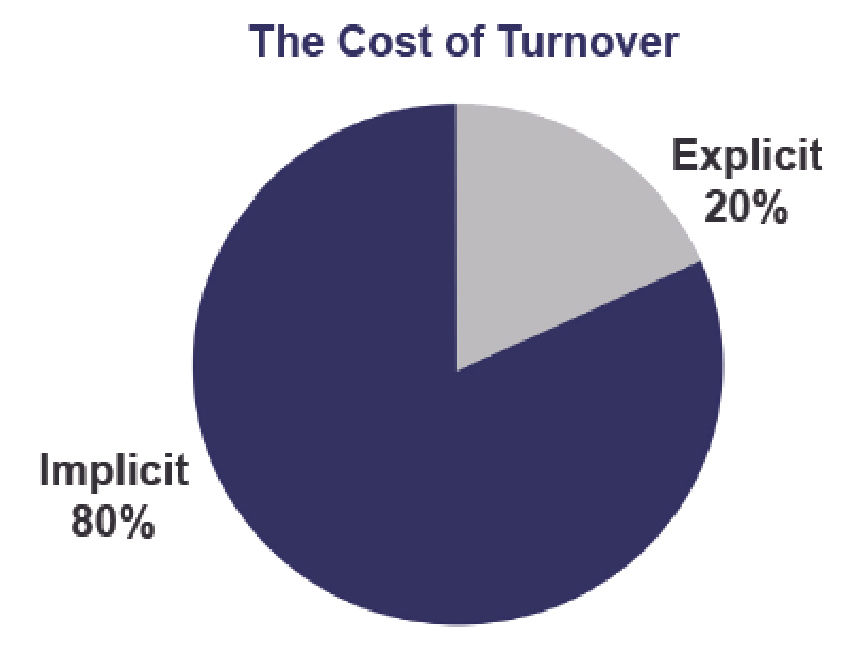

Traditionally, most people think that the costs of losing an executive are just “explicit” costs which are more tied to fees paid to a search firm to find a replacement. However, the more impactful costs are the “implicit” costs of losing a key executive, also known as opportunity costs. Thus, the summation of explicit and implicit costs illuminates the true cost (i.e., total cost) of losing an executive. Generally speaking, the total cost can be approximately 200 - 300 percent of the executive’s salary.

In 2019, according to Statista (1), 16.5% of executive teams (CEOs, CFOs and COOs) turned over. Also in 2019, according to the Work Institute (2), a shocking 42 million people voluntarily left their jobs. This equates to 27% of the workforce. This was an increase of over 2 million in 2018, which saw 40 million voluntary departures and an increase of over 88% since 2010.

It is important for companies to find ways to reduce the likelihood of this loss by creating and/or enhancing incentive plans. These plans should be designed to embrace executive retention, amplify cost savings and, more importantly, preserve the value of the enterprise.

Explicit Costs

Executives should be of paramount importance given the high costs associated with their turnover. Direct replacement costs, or explicit costs, can include search fees, legal fees (employment agreements, severance and non-compete agreements, etc.), advertising, background check and time spent internally (interviewing, screening and personal assessments) all of which can equate to 50-60% of one’s salary. For instance, suppose a 45-year-old executive makes $250,000 annually, then decides to work for a different organization. Under the general assumption, tangible direct replacement costs and other related costs would range from $125,000-$150,000.

Implicit Costs

Explicit costs represent just part of the true cost of losing an executive: implicit costs can also be impactful. The time necessary to replace the executive alone would constitute a high opportunity cost. The alternative where the executive stays and remains productive during the same time period is usually preferred.

This opportunity cost can entail other factors, such as a negative work atmosphere that contributes to employee disengagement. Per Gallup, employee disengagement costs the US economy upwards of $350 billion per year (3) (note: other employees who see high turnover tend to disengage and lose productivity).

From a company standpoint, the lost productivity and engagement of employees associated with a departed executive can create costs equal to $10,000 or more per year, per employee. For example, if an executive’s departure impacts even just 10 employees, implicit costs associated with disengagement alone could total $100,000. Other implicit costs that need to be considered are as follows:

-

Cost of Onboarding - training and management time.

-

Lost Productivity - it may take a new employee one to two years to reach the productivity of an existing executive.

-

Lack of Customer Service and Increased Errors - for example, new employees take longer and are often less adept at solving problems.

-

Long Term Training Cost - over two to three years, a business will invest 10 to 20 percent of an employee’s salary or more in training.

-

Cultural Impact - whenever someone leaves, others take time to ask why.

Losing a key member of your team can be extremely painful and challenging for the entire organization. Moreover, it can create costs that most have never considered or even know how to measure. What is the solution? How can companies reduce or even eliminate the economic impact of unexpectedly losing a key executive?

Pay to Stay vs. Pay to Go

The focus should be finding cost effective ways to motivate and encourage executives to build their careers at your organization. Rewarding executives based on performance and years of service are two drivers that can be incorporated into every executive retention plan. There are two ways to deliver value to an executive and reward them for their commitment and loyalty; cash and benefits.

-

Delivery of cash with an accompanying vesting schedule and a predetermined payout can be extremely “sticky”. There can also be a non-compete incorporated into the plan design.

-

Delivery of benefits based on years of service whereby the benefits are paid for 100% by the company and/or benefits can be structured to be portable to the executive are seen as extremely attractive.

We will explore a Long-Term Incentive Plan (LTIP) and other executive benefit plans that take into consideration both of these strategies. The goal is to put plans in place that are less costly than the economic impact of losing a key executive.

Cash — Long-Term Incentive Plan

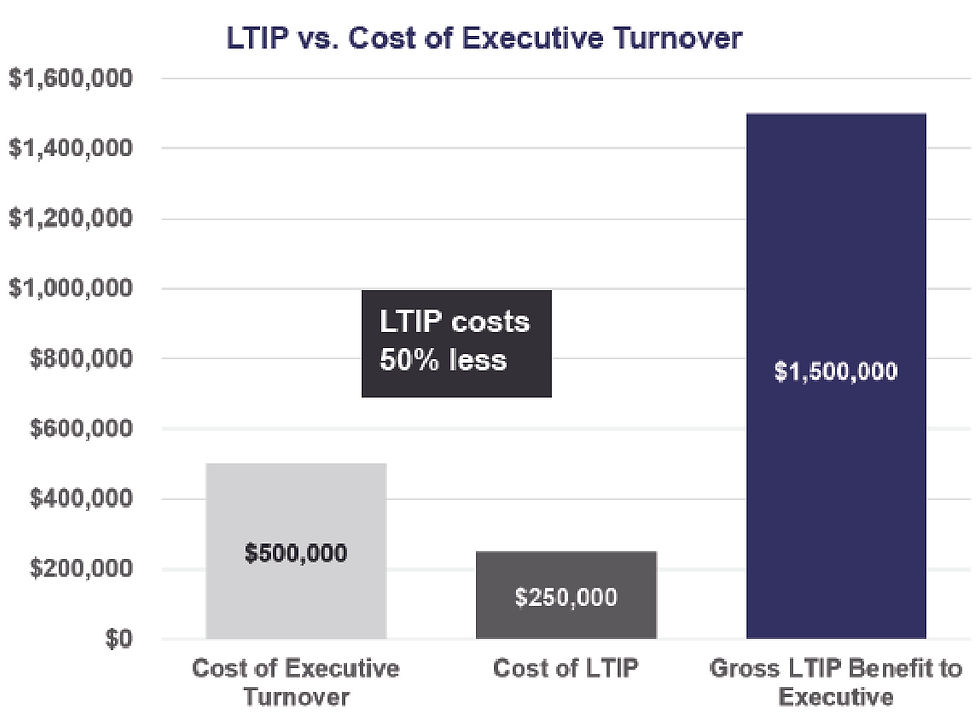

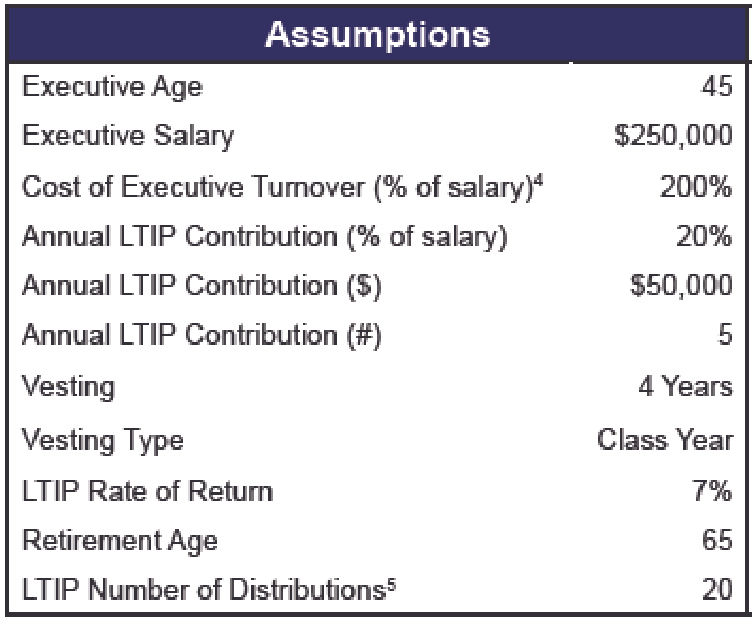

Establishing an LTlP can reduce the company’s explicit hiring and training costs by 50 percent. The true savings created by an LTlP becomes even greater when considering the implicit costs associated with losing an executive.

The most impactful LTIP’s deliver both an immediate cash component and a deferred cash component. The immediate cash component is typically tied to a vesting schedule whereby a percentage of the LTlP benefits are delivered based on a vesting schedule (e.g., 1/3 vested a year, 100% vested in 3 years). A common percentage paid out over the vesting schedule is 50% of the total LTlP benefits. The remaining 50% that is deferred can be invested to earn a tax deferred rate of return and paid at a future point in time (e.g., 10 years, retirement age, etc.). It is this deferral component that creates the “golden handcuff” and is utilized to retain the executives in the long term.

Below is a hypothetical graphical cost comparison of establishing an LTIP vs. incurring the costs of losing an executive.

Long-Term Incentive Plan (LTIP)*

Benefits - Split Dollar and Executive Long-Term Care

In addition to cash, there can be substantial value in providing executives and their families with valued benefits. The benefits provided would be in addition to traditional employee benefits. Two of the most popular benefits for executives are establishing a split dollar plan and an executive long term care plan. Both plans can be established without any P&L impact to the company while providing substantial cash benefits to the executives and their families.

A split dollar plan is a structure that allows a company to provide tax free life insurance benefits to an executive with little cost being incurred by the executive. Moreover, based on years of service, a cash component can be designed into the plan at retirement age or after a certain period of time. It is important to note that the plan can be designed to recover 100% of the company’s costs.

An “investment oriented” long term care insurance plan can provide executives with substantial tax-free benefits in the event they lose two of five daily living activities. The premium is paid for by the company which creates a money market account on the balance sheet of the company. In the event the benefit is not utilized by the executive either because a) they didn’t meet the minimum number of years of service required to receive the benefit or b) they remain healthy, the company will be returned 100%+ of their premiums.

Executive Summary

The true cost of losing an executive equals the summation of the explicit and implicit costs that arise upon their departure, with the latter representing the most formidable costs, depending upon the quality of talent lost and the quality of the talent acquired. As Zappos CEO once remarked, poorly chosen hires have cost the company “well over $100 million” (6). It is clear that a company can be much better off creating ways to retain talent rather than taking on the risks of hiring new talent; the known usually outweighs the unknown.

Companies across the country pay these costs every year for multiple executives which runs into the millions of dollars. By way of example, a company with $1 billion in revenue, depending on the industry, will generally have about 250 executives that are considered highly compensated executive level employees. If the average salary is $180,000 and a company loses 5% of their executive team a year (i.e., approximately 12 executives out of 250), that equates to a total cost, conservatively, of about $4.3 million. Given the magnitude of this cost and potential damage on the enterprise value of the organization, it is important for companies to ask themselves two questions:

-

What can we do to better retain our key people to effectively reduce executive turnover?

-

Is the solution something that is less costly than the economic impact that is created when an executive leaves?

Based on our experience in working with C-level talent and executive teams, it is important for a company to be proactive in understanding the cost formula:

Pay to Stay < Pay to Go

Exploring ways to reduce the impact of executive loss and, moreover, developing plans that preserve and enhance the long-term enterprise value of the organization, should be an important part of every company’s strategic plan.

More Information

For more information call (813) 367-1111 and ask for Sales, or email consulting@mezrahconsulting.com. A team member will reach out to you shortly!

Who We Are

Mezrah Consulting, based in Tampa, Florida, is a national executive benefits and compensation consulting firm specializing in plans for sizable publicly traded and

privately held companies. For more than 30 years, we have focused on the design, funding, implementation, securitization and administration of nonqualified executive benefit programs, and have advised more than 300 companies throughout the U.S.

As a knowledge-based and strategy-driven company, we offer clients highly creative

and innovative solutions by uncovering value and recognizing risks that other firms typically do not see. Custom nonqualified benefit plans are administered through our affiliate mapbenefits®, a proprietary cloud-based plan technology platform that provides enterprise plan administration for nonqualified plans, including reporting and functionality for plan participants and plan sponsors.